Which Metal Plan to Choose

Because of changes made in the health insurance market due to the Affordable Care Act (ACA), also called Obamacare, the majority of health care plans are now broken down into four “metal” categories: Bronze, Silver, Gold, and Platinum.

Metal Categories Are a Guide, Not a Rating System

We’re taught from an early age to favor anything gold. In elementary school, we get gold stars for the right behavior or good grades. We’re pushed to win by saying, “Go for the gold!” or praised by someone saying, “She’s as good as gold.” We even talk about the gold standard, by which we mean “the best.”

You need to forget all that when you are dealing with ACA health insurance “metal” categories. The federal government through their Healthcare.gov website notes the metal categories “have nothing to do with quality of care.”1 So despite what the “metal” names might imply, you do not get better care from a Gold or Platinum plan than you do from a Bronze.

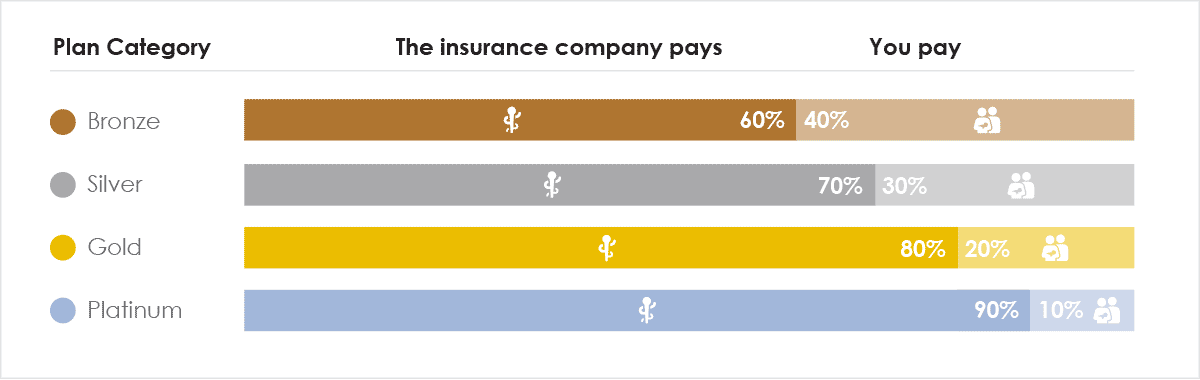

What the ACA metal levels really represent is a rough guide to how you and your insurance company share your health care costs in a given health insurance plan. The cost balance of each level breaks down like this:

So what this means, for example, is that in a Bronze health care plan, you pay for roughly 40% of your health care costs out-of-pocket. These costs include expenses like deductibles, copays, and coinsurance. The insurance company pays 60%. With the Silver, Gold and Platinum plans, the insurance company pays for more of covered expenses and you pay for less.

However, there’s a trade-off: With each plan that pays more of the out-of-pocket covered expenses for you, the amount of premium you pay each month goes up. So going back to the example of a Bronze health plan, choosing that plan means you might have a higher deductible or copays but a lower monthly premium.

All ACA health insurance plans, whatever their metal category, meet minimum essential coverage requirements and include ten essential health benefits as required by the law.

Learning Insurance Lingo

Premium - What you pay (usually monthly) for your health insurance coverage.

Deductible - The amount of covered expenses you (the insured) have to pay before the insurance company starts paying.

Copay - A standard amount (stated in your health plan) you pay for a specific medical service.

Coinsurance - The percentage you pay of any covered expenses after you’ve met your deductible.

Deciding on the Best Health Insurance Plan for You

So how do you make your choice? Obviously, there’s no one right answer to what medical insurance plan is best for you. But answering a few questions and having those answers nearby as you browse health care plans can help you narrow your choices down.

How much medical care do you or others who will be on the plan generally get in a year?

If you have significant regular doctor visits, tests, prescriptions, or therapies that could add up to a lot of out-of-pocket costs for you, then a plan in the Gold category with a higher premium but more covered expenses paid by the plan may be worth it for you.

If on the other hand, you only go to the doctor when you have to and don’t have ongoing prescriptions to worry about, a Bronze or Silver plan might be the right choice.

Are you eligible for a tax credit or cost-sharing reductions on your out-of-pocket expenses?

Your income could qualify you for both a tax credit and cost-sharing reductions on things like your copayments or out-of-pocket maximum (the total amount you are required to pay for covered medical expenses during a calendar year). Those savings may mean you could afford a Silver plan at a cost similar to a Bronze plan, so be sure to take them into consideration.

Important: While your tax credit can apply to any metal category health care plan, you must buy at least a Silver plan for cost-sharing reductions to apply.

Are you interested in a Health Savings Account?

Health Savings Accounts (HSAs) are tax-favored savings accounts that you can pair with a high deductible health insurance plan. You can set money aside in an HSA before taxes (up to the legal limit). That money is yours and earns interest just as if it were in any other savings account. Any money you withdraw to pay for medical expenses is not taxed, and interest earnings grow tax-deferred in the account.

HSAs are a great way to prepare for your own out-of-pocket medical costs. Because an HSA must be paired with a high deductible health insurance plan, that usually means you will be looking for Bronze or Silver plans.

Are the doctors you use in the plan’s network?

This has nothing to do with metal categories, but it’s an important question to answer. Check the network of any plan you are considering to see if the doctors you use regularly are participants. You can save money when your doctors participate in your medical insurance plan’s network because they will have agreed to negotiated discount rates for their services.

Use your answers to these questions and the guidance offered by the ACA metal categories to help you find the best health insurance plan and the most affordable health insurance cost balance for you and your loved ones.

Need More Information about Personal Insurance?

Questions about affordable health insurance?

Call us today.

Fast, free quotes on Short Term insurance plans that fit your lifestyle and budget!